Over 2 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course. Start Free

A trade credit is an agreement or understanding between agents engaged in business with each other that allows the exchange of goods and services without any immediate exchange of money. When the seller of goods or services allows the buyer to pay for the goods or services at a later date, the seller is said to extend credit to the buyer.

Trade credit is usually offered for 7, 30, 60, 90, or 120 days, but a few businesses, such as goldsmiths and jewelers, may extend credit for a longer period. The terms of the sale mention the period for which credit is granted, along with any cash discount and the type of credit instrument being used.

For example, a customer is granted credit with terms of 4/10, net 30. This means that the customer has 30 days from the invoice date within which to pay the seller. In addition, a cash discount of 4% from the stated sales price is to be given to the customer if payment is made within 10 days of invoicing. If instead, the terms of sale were net 7, then the customer would have 7 days from the invoice date to pay, with no discount offered for early payment.

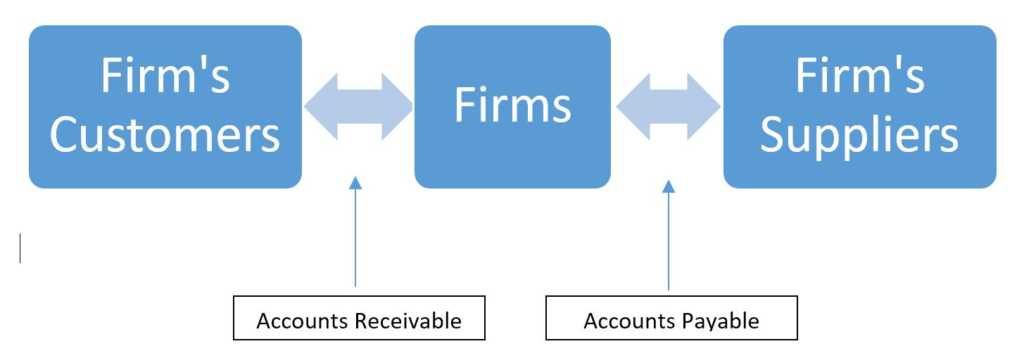

Trade credit extended to a customer by a firm appears as accounts receivable and trade credit extended to a firm by its suppliers appears as accounts payable. Trade credit can also be thought of as a form of short-term debt that doesn’t have any interest associated with it.

From a borrower’s perspective, using credit can enable expansion or development which may not be otherwise feasible if the company must pay for purchases immediately. A notable trade-off is that interest payments can accumulate and become overwhelming for borrowers (resulting in significant obligations which may compound).

Providing credit allows convenience for the borrower (resulting in more transaction activity) and recurring interest income for the lender. Providing a borrower with credit has default risk associated with it, as a borrower may be unable to pay off the required debt obligations.

Credit periods vary among different industries. For example, a jewelry store may sell diamond engagement rings for 5/30, net 4 months. A food wholesaler, selling fresh fruit and produce, may use net 7. Generally, a firm must consider three factors in setting a credit period:

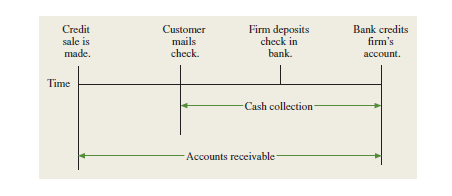

Lengthening the credit period effectively reduces the price paid by the customer. Generally, this increases sales. Cash flows as a result of trade credit being granted are shown below:

Most credit is offered on open account. This means that the only formal credit instrument used is the invoice, which is sent with the shipment of goods, and which the customer signs as evidence that the goods have been received. Afterward, the firm and its customers record the exchange on their accounting books. At times, the firm may require the customer to sign a promissory note or IOU. This is used when the order is large and when the firm anticipates a possible problem in the collection.

Promissory notes can eliminate problems later regarding the existence of a credit agreement. One problem with promissory notes is that they are signed after delivery of the goods. One way to obtain a credit commitment from a customer before the goods are delivered is through a commercial draft. The selling firm typically writes a commercial draft calling for the customer to pay a specific amount by a specified date. The draft is then sent to the customer’s bank along with the shipping invoices.

The bank will then ask the buyer to sign the draft before turning over the invoices. The goods can then be shipped to the buyer. If immediate payment is required, it is called a sight draft. Here, funds must be turned over to the bank before the goods are shipped.

Frequently, even a signed draft is not enough for the seller. In such a case, the seller may demand that the banker pays for the goods and collect the money from the customer. When the banker agrees to do so in writing, the document is called a banker’s acceptance. That is, the banker accepts responsibility for payment.

As banks generally are well-known and well-respected institutions, the banker’s acceptance becomes a liquid instrument. In other words, the seller can then sell (usually at a discount) the banker’s acceptance in the secondary market.

When granting credit, a firm tries to distinguish between customers who will pay and customers who will not pay. There are a number of sources of information to determine creditworthiness, including the following:

Trade credit mostly helps those businesses that find other avenues of credit closed to them for one reason or another. Young firms that do not have an established credit history may find traditional financing options, such as debt and equity financing, unavailable to them.

The rise of alternative means of funding, such as crowdfinancing and peer-to-peer lending, can be seen as evidence of this. Outside the United States, it has been found that trade credit accounts for approximately 20% of all investments that are financed through external sources, with bank credit used more than trade credit.

To learn more about credit and business financing, see the following free CFI resources:

Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst.